Stop Waiting, Start Owning!

Why Today's Market Beats Tomorrow's Regret.

"Yesterday was the best time to buy a home, but the next best time is today." That adage rings truer than ever in today's real estate market. With persistent home value appreciation and fluctuating mortgage rates, many prospective buyers are caught in a "wait and see" dilemma. However, timing the market is a risky strategy that could lead to significant financial setbacks.

Debunking the Myth: Home Prices Won't Plunge

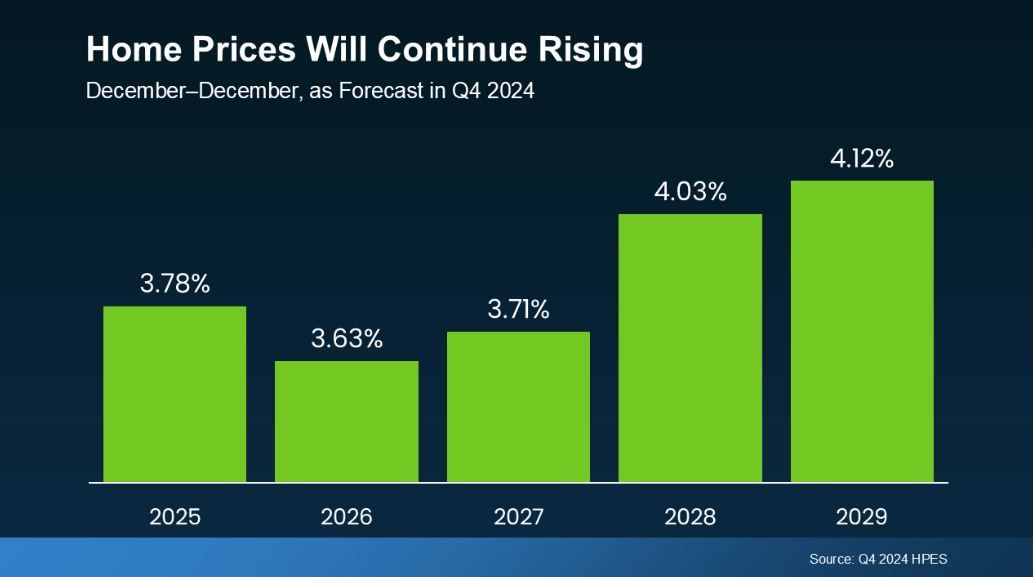

The notion of a dramatic price drop is largely wishful thinking. According to Fannie Mae's Home Price Expectations Survey, experts predict sustained home price growth through at least 2029. While the frenzied spikes of recent years have subsided, a steady, sustainable annual increase of 3-4% is projected nationwide, signaling a return to a more balanced market.

The Cost of Waiting: Real Numbers, Real Impact

Waiting for the "perfect" moment can be costly. Here's why:

- Rising Purchase Prices: As home values climb, the longer you wait, the more you'll pay for the same property.

- Rate vs. Price Trade-Off: Even if mortgage rates dip slightly, rising home prices can offset any potential savings, making waiting more expensive overall.

- Equity Building: Buying now allows you to start building equity immediately, leveraging the consistent appreciation in home values.

Example:

Consider a $400,000 home purchased today. Based on projected appreciation, that home could gain over $83,000 in value within five years. That's substantial wealth creation that you'd miss by staying on the sidelines.

The Supply and Demand Equation:

Despite increased inventory compared to recent years, the housing market remains a supply-constrained environment. Demand continues to outpace supply, putting upward pressure on prices. As Redfin notes, "Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand."

Time in the Market vs. Timing the Market:

Real estate favors those who participate, not those who speculate. Instead of trying to predict market fluctuations, focus on your individual circumstances and financial readiness.

Strategies for Success:

- Explore diverse neighborhoods.

- Consider alternative housing options like condos or townhomes.

- Consult with a lender about flexible financing solutions.

- Investigate down payment assistance programs.

When you have questions about buying a home, reach out to your favorite FAIRWAY Loan Officer or call the office at 717-431-9299 and ask for assistance or email me at kenp@fairwaymc.com/ We Serve People.

#Howtobuyahome #Firsttimehomebuyers #Moveupbuyers #FairwayPA