Introducing FAIRWAY’s, Cash Guarantee Program

Closing Loans As Promised, As Scheduled, GUARANTEED

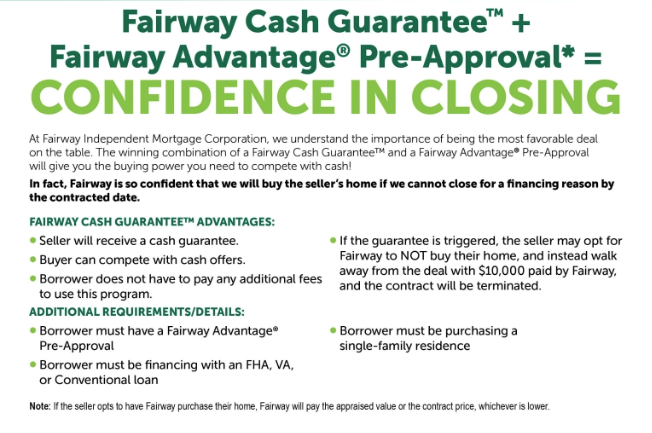

Introducing FAIRWAY’s

Cash Guarantee Program

Here’s how it works:

- You come to FAIRWAY for Pre-Approval.

- We collect the necessary documents required for a mortgage application.

- We pull credit, we review the documentation, review with our underwriters and get clarifications when needed.

- We issue a real Pre-Approval with the Guaranteed Stamp on it.

- We call you and your Realtor®, and we also call the Listing Agent to describe the Guarantee and strength of borrower when you are submitting an offer.

How it helps you!

- Stronger offers on the table in a competing bid situation.

- More confidence from Listing Agent and Seller.

- Help you work with a local lender that “Guarantees” their work, rather than with internet / out of area Pre-Approval Letters.

- You will enjoy being able to avoid issues.

- You will be protected by our secure documentation collection methods.

What We Need From You

In order to pull a credit report, we will need:

- Full Names

- Social Security Numbers

- Home Address & Phone Number

- Copy of W2s and tax returns for the last 2 years.

- Copy of 2 months most recent bank statements (all pages please, even if blank).

- Copy of 1 month most recent pay stubs.

- One way to provide us with information we need to start your file is to fill out our secure Online Application.

Do

- Provide all pages of bank and asset statements, even if blank. If your statements indicate large deposits we will need to have a paper trail showing where the deposits came from and why.

- Stay current on your existing accounts.

- Opt out from the credit bureau lists at www.optoutprescreen.com to protect yourself from potential identity theft and so you aren’t bombarded with unsolicited offers after settlement.

Don't

- Don’t worry about rates yet. When you have a home selected and are at the Application stage, then together we can begin watching for the best time to lock a rate.

- Don’t provide teller or internet print-outs for bank statements – we cannot use them.

- Don’t apply for new credit when applying for a mortgage. A new debt could change everything.

- Don’t close credit card accounts or consolidate your debts onto one card.