Do you need perfect credit to buy a home? Check this out...

Many people believe they need higher scores than they actually do.

When it comes to buying a home, many people hesitate—not because they aren’t ready, but because they think their credit score isn’t. In fact, a recent study by Fannie Mae found that 90% of buyers either don’t know the minimum credit score needed for a mortgage or assume it’s higher than it really is.

Let that sink in... That means a lot of qualified buyers are sitting on the sidelines, believing homeownership is out of reach—when it may be closer than they think.

What Credit Score Do You Really Need To Buy a Home?

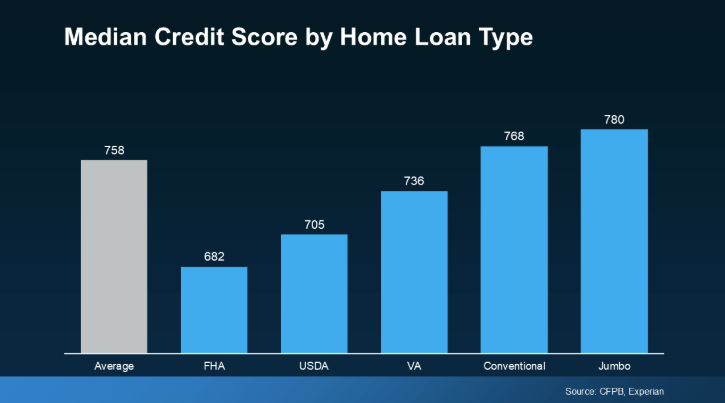

Here’s the truth: there’s no single credit score required to get approved for a mortgage. Lenders look at a range of scores depending on the loan type—FHA, VA, conventional—and other factors like income, debt, and down payment.

According to FICO:

“Each lender has its own strategy... There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use.”

So if you’ve been putting off your home search because you think you don’t qualify... you might want to think again.

Why Your Credit Score Still Matters

While there’s flexibility, your credit score still plays a major role in:

- What type of loan you qualify for

- Your interest rate

- Your monthly mortgage payment

- How much home you can afford

As Bankrate puts it:

“Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

In short, a stronger credit score can save you thousands over the life of your loan.

How To Improve Your Credit Score Before Buying a Home

Want to give your score a boost before applying for a mortgage? Here are some tips from the Federal Reserve that actually work:

- Pay your bills on time. Payment history makes up a large portion of your score.

- Lower your credit card balances. Aim to keep usage below 30% of your credit limit.

- Check your credit reports. Dispute any errors that could be dragging your score down.

- Avoid opening new credit accounts. Too many new inquiries can hurt your score temporarily.

Final Thought

Don’t let your credit score hold you back from homeownership. Whether you're just getting started or ready to take the next step, connect with a local mortgage expert who can guide you through the numbers and help you explore real options—no guesswork required.