Buying or Selling? Offer a Little Extra Love

When you’re buying or selling a home, the finances, the inspections, and all the other nitty gritty details are important. But at the end of the day, you’re a buying a home from — or selling a home to — another human being. Making a kind gesture can go a long way in terms of enticing a seller to choose you or incentivizing a buyer to select your property. Here are some ways to show buyers or sellers some love.

If you’re trying to buy a home — especially in a competitive real estate market, and especially if you’re making an offer under asking price — you could provide the seller with an offer letter that waives a few contingencies. For

example, waiving your inspection contingency or at least shortening it will tell the seller that you’re serious and willing to take this risk. Your offer will stand out as one that can get done quickly and hassle-free. I’d be happy to guide you through this process.

If you don’t need some of your furniture or window coverings in your new home, why not offer to include some of them in the sale? Filling up a new home with furniture is costly, and if your potential buyers have a lot of it to buy, they may be incentivized if they know they’ll save money on furniture and decor. If it’s furniture you were planning to get rid

of anyway, it also takes away the potential headache of having to figure out what to do with it.

For new homebuyers, the down payment and closing costs can be overwhelming, and that’s before you factor in recurring costs of homeownership. If you live in a neighborhood or building that charges HOA fees, one way to incentivize buyers is to extend a credit on HOA dues. You can do it for the time of your choosing, such as six months or one year, which takes some

financial pressure off the buyer. Just have your realtor check that there aren’t any issues with your buyer’s lender since some have guidelines around seller credits.

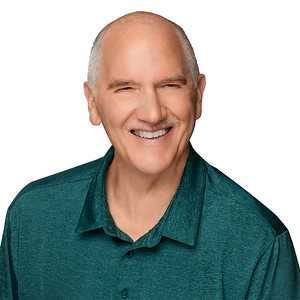

If you’re ready to make a move and need help getting pre-approved for a mortgage, give me a call, text or reply to this email to talk about your next steps.

Ken Pederson

Branch Manager, MMS

FAIRWAY Independent Mortgage Corp.

717-431-9299

https://www.KenPedersonLoans.com `

nmls: 134943